Multiple Choice

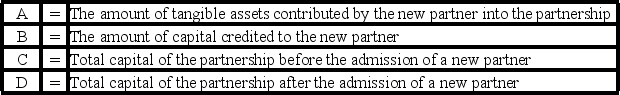

-Refer to the above information.Which statement below is correct if a new partner receives a bonus upon contributing assets into the partnership?

A) B < A and D = C − A

B) B > A and D = C + A

C) A = B and A = D + C

D) B > A and C = D + A

Correct Answer:

Verified

Correct Answer:

Verified

Q5: In the JK partnership,Jacob's capital is $140,000,and

Q6: A partnership is a(n):<br>I.accounting entity.<br>II.taxable entity.<br>A)I only<br>B)II

Q7: In the JK partnership,Jacob's capital is $140,000,and

Q8: When a partner retires from a partnership

Q9: The PQ partnership has the following plan

Q11: Which of the following statements best describes

Q12: In the JK partnership,Jacob's capital is $140,000,and

Q13: In the JAW partnership,Jane's capital is $100,000,Anne's

Q14: The DEF partnership reported net income of

Q15: The APB partnership agreement specifies that partnership