Essay

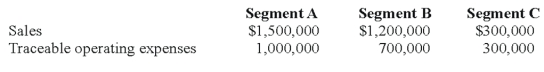

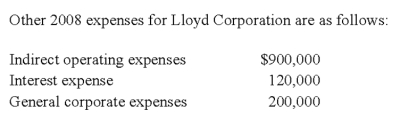

47.Lloyd Corporation reports the following information for 2008 for its three operating segments:

Indirect operating expenses are allocated to segments based upon the ratio of each segment's traceable operating expenses to total traceable operating expenses.Interest expense is allocated to segments based upon the ratio of each segment's sales to total sales.

Required:

a)Calculate the operating profit or loss for each of the segments for 2008.

b)Determine which segments are reportable,applying the operating profit or loss test.

Answer:

Answer:

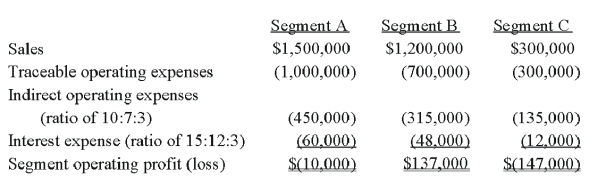

a)Operating profit or loss for each segment.

Note: General corporate expenses are not allocated for the purpose of identifying reportable segments.

b)Reportable segments.

Segments B and C both meet the operating profit or loss test.The absolute dollar amount of their respective operating profit and loss amounts are 10% or more of the absolute dollar amount of the combined segment operating losses of $157,000 ($10,000 loss + $147,000 loss).

-FASB 131 (ASC 280),Disclosure about Segments of an Enterprise and Related Information,has taken what has been referred to as a "management approach" to the definition of a segment and the allocation of costs to a segment.

Required:

a)What is meant by a management approach? How does this concept of a management approach impact the decision to disclose information?

b)How are decisions about cost allocation handled in segment disclosures?

Correct Answer:

Verified

a)FASB 131 (ASC 280)focuses on financial...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q3: Wakefield Company uses a perpetual inventory system.In

Q8: Missoula Corporation disposed of one of its

Q13: All of the following are differences between

Q42: Trimester Corporation's revenue for the year ended

Q43: Trevor Company discloses supplementary operating segment information

Q45: Toledo Imports,a calendar-year corporation,had the following income

Q46: William Corporation,which has a fiscal year ending

Q48: Tyler Company incurred an inventory loss due

Q53: Estimated gross profit rates may be used

Q62: An analysis of Abbey Company's operating segments