Multiple Choice

Global Corporation acquired 85 percent of Local Company's voting shares of stock in 20X7.During 20X8,Global purchased 50,000 picture tubes for $15 each and sold 28,000 of them to Local for $20 each.Local sold all of the units to unrelated entities prior to December 31,20X8,for $30 each.Both companies use perpetual inventory systems.

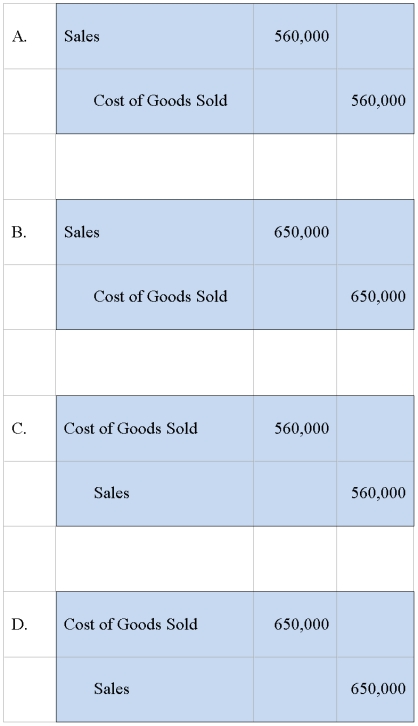

Which worksheet eliminating entry is needed in preparing consolidated financial statements for 20X8 to remove all effects of the intercompany sale?

A) Option A

B) Option B

C) Option C

D) Option D

Correct Answer:

Verified

Correct Answer:

Verified

Q5: Pepper Corporation owns 75 percent of Salt

Q17: Perth Corporation owns 90 percent of Sydney

Q18: Sub Company sells all its output at

Q22: ABC Corporation owns 75 percent of XYZ

Q23: 44.Colton Company acquired 80 percent ownership of

Q29: Padre Company purchases inventory for $70,000 on

Q42: Pilfer Company acquired 90 percent ownership of

Q44: Senior Inc.owns 85 percent of Junior Inc.During

Q46: Parent Corporation owns 90 percent of Subsidiary

Q53: Sub Company sells all its output at