Multiple Choice

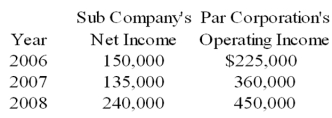

Sub Company sells all its output at 20 percent above cost to Par Corporation.Par purchases its entire inventory from Sub.The incomes reported by the companies over the past three years are as follows:

Sub Company sold inventory for $300,000,$262,500 and $337,500 in the years 20X6,20X7,and 20X8 respectively.Par Company reported ending inventory of $105,000,$157,500 and $180,000 for 20X6,20X7,and 20X8 respectively.Par acquired 70 percent of the ownership of Sub on January 1,20X6,at underlying book value.The fair value of the noncontrolling interest at the date of acquisition was equal to 30 percent of the book value of Sub Company.

-A subsidiary made sales of inventory to its parent at a profit this year.The parent,in turn,sold all but 20 percent of the inventory to unaffiliated companies,recognizing a profit.The amount that should be reported as cost of goods sold in the consolidated income statement prepared for the year should be:

A) the amount reported as intercompany sales by the subsidiary.

B) the amount reported as intercompany sales by the subsidiary minus unrealized profit in the ending inventory of the parent.

C) the amount reported as cost of goods sold by the parent minus unrealized profit in the ending inventory of the parent.

D) the amount reported as cost of goods sold by the parent.

Correct Answer:

Verified

Correct Answer:

Verified

Q5: Pepper Corporation owns 75 percent of Salt

Q17: Perth Corporation owns 90 percent of Sydney

Q19: Global Corporation acquired 85 percent of Local

Q22: ABC Corporation owns 75 percent of XYZ

Q23: 44.Colton Company acquired 80 percent ownership of

Q29: Padre Company purchases inventory for $70,000 on

Q44: Senior Inc.owns 85 percent of Junior Inc.During

Q46: Parent Corporation owns 90 percent of Subsidiary

Q53: Sub Company sells all its output at

Q61: On January 1,20X8,Parent Company acquired 90 percent