Multiple Choice

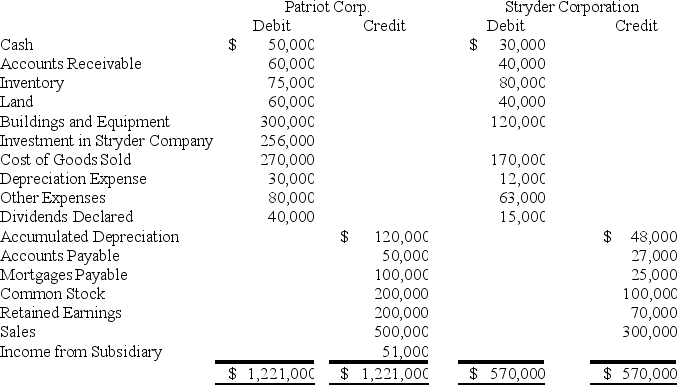

On January 1,20X8,Patriot Company acquired 100 percent of Stryder Company for $220,000 cash.The trial balances for the two companies on December 31,20X8,included the following amounts:

On the acquisition date,Stryder reported net assets with a book value of $170,000.A total of $10,000 of the acquisition price is applied to goodwill,which was not impaired in 20X8.Stryder's depreciable assets had an estimated economic life of 10 years on the date of combination.The difference between fair value and book value of tangible assets is related entirely to buildings and equipment.Patriot used the equity method in accounting for its investment in Stryder.Analysis of receivables and payables revealed that Stryder owed Patriot $10,000 on December 31,20X8.

On the acquisition date,Stryder reported net assets with a book value of $170,000.A total of $10,000 of the acquisition price is applied to goodwill,which was not impaired in 20X8.Stryder's depreciable assets had an estimated economic life of 10 years on the date of combination.The difference between fair value and book value of tangible assets is related entirely to buildings and equipment.Patriot used the equity method in accounting for its investment in Stryder.Analysis of receivables and payables revealed that Stryder owed Patriot $10,000 on December 31,20X8.

-Based on the information provided,what amount of total assets will be reported in the consolidated balance sheet for the year?

A) $895,000

B) $801,000

C) $723,000

D) $1,111,000

Correct Answer:

Verified

Correct Answer:

Verified

Q10: On December 31,20X1,Pine Corporation acquired 100 percent

Q11: Pace Corporation acquired 100 percent of Spin

Q12: Paccu Corporation acquired 100 percent of Sallee

Q13: Paris,Inc.holds 100 percent of the common stock

Q14: Pace Corporation acquired 100 percent of Spin

Q16: Pizza Corporation acquired 100 percent of Slice

Q17: Company P acquires 100 percent of the

Q18: Which of the following observations is NOT

Q19: On December 31,20X8,Polaris Corporation acquired 100 percent

Q20: Paccu Corporation acquired 100 percent of Sallee