Multiple Choice

Use the information below to answer the following question(s) :

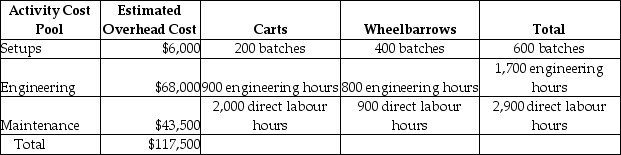

Vittoria Corporation manufactures two products-Carts and Wheelbarrows. The annual production and sales of Carts is 2,000 units, while 1,800 units of Wheelbarrows are produced and sold. The company has traditionally used direct labour hours to allocate its overhead to products. Carts require 1.0 direct labour hours per unit, while Wheelbarrows require 0.5 direct labour hours per unit. The total estimated overhead for the period is $117,500. The company is looking at the possibility of changing to an activity-based costing system for its products. If the company used an activity-based costing system, it would have the following three activity cost pools:

Expected Activity

-The overhead cost per Wheelbarrow using the traditional costing system would be closest to

A) $65.28.

B) $40.52.

C) $20.26.

D) $18.01.

Correct Answer:

Verified

Correct Answer:

Verified

Q1: Companies that use departmental overhead rates trace

Q2: Use the information below to answer the

Q3: Use the information below to answer the

Q4: Use the information below to answer the

Q7: Use the information below to answer the

Q8: Use the information below to answer the

Q9: Use the information below to answer the

Q11: Credit Valley Products manufactures its products in

Q24: The estimated total manufacturing overhead costs that

Q192: The benefits of adopting ABC/ABM are higher