Essay

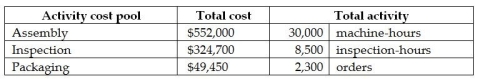

Red Stone Manufacturing, a manufacturer of a variety of products, uses an activity-based costing system. Information from its system for the year for all products follows:  Red Stone Manufacturing makes 400 of its product B34 a year, which requires a total of 52 machine hours, 15 inspection hours, and 20 orders. Product B34 requires $75.50 in direct materials per unit and $68.80 in direct labour per unit. Product B34 sells for $180 per unit.

Red Stone Manufacturing makes 400 of its product B34 a year, which requires a total of 52 machine hours, 15 inspection hours, and 20 orders. Product B34 requires $75.50 in direct materials per unit and $68.80 in direct labour per unit. Product B34 sells for $180 per unit.

Required:

A. Calculate the cost pool activity rate for each of the three activities.

B. How much manufacturing overhead would be allocated to Product B34 in total?

C. What is the product margin in total for Product B34?

Correct Answer:

Verified

Correct Answer:

Verified

Q20: To determine the amount of overhead allocated,

Q23: Activity-based management refers to using activity-based cost

Q111: Heese Corporation manufactures two products-Tricycles and Wagons.

Q112: Cost versus benefit should be a criterion

Q113: When calculating the total amount of manufacturing

Q115: The cost allocation rate for each activity

Q115: The allocation base selected for each department

Q118: Using factory utilities would most likely be

Q119: Use the information below to answer the

Q132: Facility-level activities and costs are incurred no