Essay

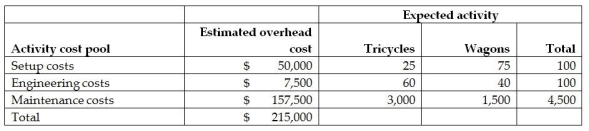

Heese Corporation manufactures two products-Tricycles and Wagons. The annual production and sales of Tricycles is 2,000 units, while 1,500 units of Wagons are produced and sold. The company has traditionally used direct labour hours to allocate its overhead to products. Tricycles require 1.5 direct labour hours per unit, while Wagons require 1.0 direct labour hours per unit. The total estimated overhead for the period is $215,000. The company is looking at the possibility of changing to an activity-based costing system for its products. If the company used an activity-based costing system, it would have the following three activity cost pools:

Required:

A. Calculate the overhead per unit for a Wagon using the traditional system based on a single-wide overhead rate (use direct labour hours as the cost driver).

B. Calculate the overhead per unit for a Wagon using the activity-based costing system.

Correct Answer:

Verified

Correct Answer:

Verified

Q106: Companies with higher direct costs in relation

Q107: The cost of depreciation, insurance, and property

Q108: Cost distortion results in the<br>A) overcosting of

Q109: The _ system focuses on activities as

Q112: Cost versus benefit should be a criterion

Q113: When calculating the total amount of manufacturing

Q115: The allocation base selected for each department

Q115: The cost allocation rate for each activity

Q116: Red Stone Manufacturing, a manufacturer of a

Q207: Merchandising and service companies, as well as