Multiple Choice

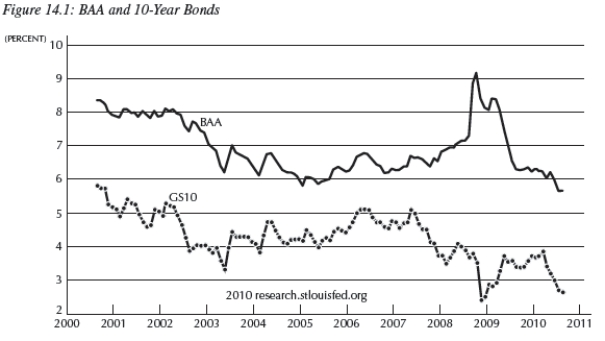

Use the figure below for the following questions;it shows the BAA corporate and 10-Year Treasury Bond yields.

-Consider Figure 14.1 above.The difference between these two curves can be interpreted as:

A) the risk premium.

B) inflation expectations.

C) the risk-free rate.

D) a market imperfection.

E) the prime lending rate.

Correct Answer:

Verified

Correct Answer:

Verified

Q46: To identify an asset bubble, economists and

Q58: In response to the Great Recession, the

Q75: When inflation is negative it:<br>A)raises the real

Q76: You are a newly hired reporter for

Q77: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB4305/.jpg" alt=" -Consider Figure 14.5

Q78: In the AS/AD framework,the risk premium appears

Q79: In the aftermath of the financial crisis

Q81: In a paper by Minneapolis Fed bank

Q83: The Squam Lake Group is a group

Q85: The burst of the housing bubble can