Essay

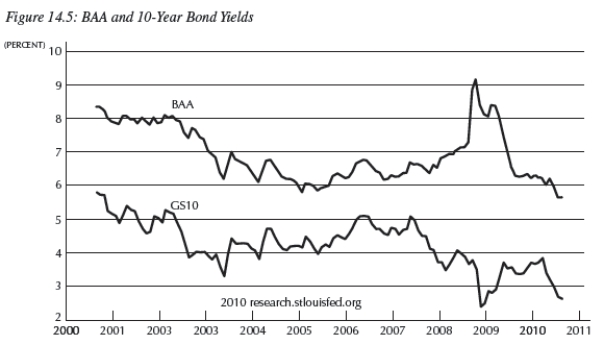

-Consider Figure 14.5 which shows the ten-year bond yield (line with diamonds)and the yield on BAA corporate bonds (line),to answer the following questions.

a.What is the difference between the two yields referred to? Explain.

b.What caused the sharp divergence between these two yields in late 2008? Explain.

c.Explain the dynamics of the decline in 10-year bond yield and the increases in the BAA bond yield during that time.

Correct Answer:

Verified

a.It is the risk premium,or spread,  ,wi...

,wi...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q32: If the rate of inflation is 2

Q58: In response to the Great Recession, the

Q72: When the Fed lowers the nominal interest

Q73: Banks which are deemed too big to

Q75: When inflation is negative it:<br>A)raises the real

Q76: You are a newly hired reporter for

Q78: In the AS/AD framework,the risk premium appears

Q79: In the aftermath of the financial crisis

Q80: Use the figure below for the following

Q81: In a paper by Minneapolis Fed bank