Essay

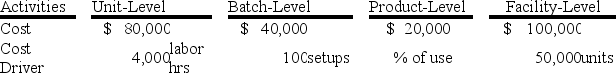

Roadmaster Tires produces a variety of auto and truck tires at its Indianapolis manufacturing plant.The plant is highly automated and uses an activity-based costing system to allocate overhead costs to its various product lines.The costs and cost drivers associated with four activity cost pools are given below:

Production of 1,000 units of a small tractor tire required 200 labor hours and two setups and consumed 10% of the product sustaining activities.

Production of 1,000 units of a small tractor tire required 200 labor hours and two setups and consumed 10% of the product sustaining activities.

Required:

1)Instead of using ABC,suppose the company had used labor hours as a company-wide allocation base.How much total overhead would have been allocated to the tractor tire?

2)How much total overhead cost will be allocated to the tire under activity-based costing?

3)What price will be quoted if the product is priced at 25% above cost? Compute the price under both the direct labor hours approach and under activity-based costing.The direct manufacturing costs consist of direct material of $20 and direct labor of $30.

4)What implications does ABC have on a company that bids on contracts using the costing approach described in Requirement 3?

Correct Answer:

Verified

1)Overhead allocated using direct labor:...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q9: The concept of cost of quality is

Q10: Total quality control cost is the sum

Q11: The number of activity cost centers used

Q12: Direct labor hours is an appropriate cost

Q13: Morris Company allocates overhead based on direct

Q15: Downstream costs are not relevant to a

Q16: What is the likely consequence of using

Q17: In a highly automated manufacturing company,labor costs

Q18: In the below graph,which shows the relationship

Q19: What is the principal reason that direct