Multiple Choice

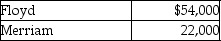

Floyd and Merriam start a partnership business on June 12,2019.Their capital account balances as of December 31,2020 stood as follows:

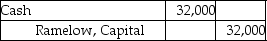

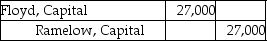

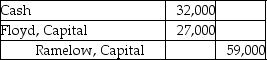

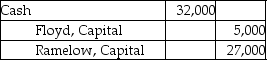

Floyd agrees to sell half of his share to Ramelow in exchange for $32,000 cash.Which of the following is the correct journal entry in the books of the firm for the above transfer of interest?

A)

B)

C)

D)

Correct Answer:

Verified

Correct Answer:

Verified

Q18: The death of a partner dissolves the

Q39: When a partner sells his interest to

Q73: If a partner's capital account is credited

Q110: An asset received from a partner as

Q134: Bob and Bill allocate 2/3 of their

Q135: Which of the following is true when

Q138: In which of the following ways does

Q142: Allan and Ralph are partners.Allan has a

Q143: Which of the following is true of

Q144: The balance sheet of Ryan and Peter