Multiple Choice

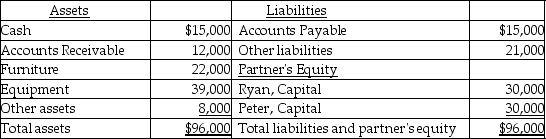

The balance sheet of Ryan and Peter firm as on December 31,2017,is given below.

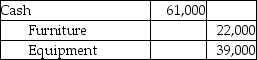

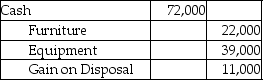

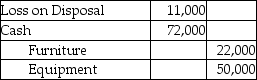

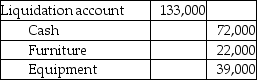

Ryan and Peter share profits in the ratio 3:2.They have decided to liquidate the partnership with immediate effect.They sold the furniture and equipment for $72,000.Which of the following is the correct journal entry for the sale transaction?

A)

B)

C)

D)

Correct Answer:

Verified

Correct Answer:

Verified

Q73: If a partner's capital account is credited

Q110: An asset received from a partner as

Q139: Floyd and Merriam start a partnership business

Q142: Allan and Ralph are partners.Allan has a

Q143: Which of the following is true of

Q145: The articles of partnership is a written

Q146: Keith and Jim are partners.Keith has a

Q147: Which of the following is true of

Q148: The financial statements of a partnership are

Q149: The balance sheet of Ryan and Peter