Multiple Choice

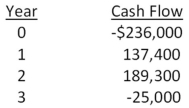

Blue Water Systems is analyzing a project with the following cash flows.Should this project be accepted based on the discounting approach to the modified internal rate of return if the discount rate is 14 percent? Why or why not?

A) Yes;The MIRR is 13.48 percent.

B) Yes;The MIRR is 17.85 percent.

C) Yes;The MIRR is 21.23 percent.

D) No;The MIRR is 5.73 percent.

E) No;The MIRR is 17.85 percent.

Correct Answer:

Verified

Correct Answer:

Verified

Q18: A project will produce cash inflows of

Q25: The internal rate of return is defined

Q41: What is the net present value of

Q42: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB5617/.jpg" alt=" -Home Décor &

Q47: Consider the following two mutually exclusive projects:

Q50: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB5617/.jpg" alt=" -You are analyzing

Q52: The internal rate of return is: <br>A) the

Q66: Which one of the following is the

Q76: A project has average net income of

Q106: Explain how the internal rate of return