Multiple Choice

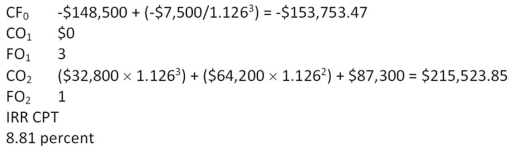

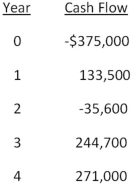

-Home Décor & More is considering a proposed project with the following cash flows.Should this project be accepted based on the combination approach to the modified internal rate of return if both the discount rate and the reinvestment rate are 16 percent? Why or why not?

A) Yes;The MIRR is 14.78 percent.

B) Yes;The MIRR is 17.42 percent.

C) No;The MIRR is 12.91 percent.

D) No;The MIRR is 14.78 percent.

E) No;The MIRR is 17.42 percent.

Correct Answer:

Verified

Correct Answer:

Verified

Q18: A project will produce cash inflows of

Q37: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB5617/.jpg" alt=" -A firm evaluates

Q41: What is the net present value of

Q43: A project has a discounted payback period

Q45: Blue Water Systems is analyzing a project

Q47: Consider the following two mutually exclusive projects:

Q52: The internal rate of return is: <br>A) the

Q76: A project has average net income of

Q99: Which of the following statements related to

Q106: Explain how the internal rate of return