Multiple Choice

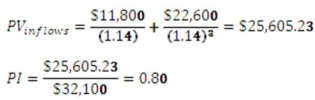

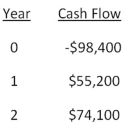

-You would like to invest in the following project.

Sis,your boss,insists that only projects returning at least $1.06 in today's dollars for every $1 invested can be accepted.She also insists on applying a 14 percent discount rate to all cash flows.Based on these criteria,you should:

A) accept the project because the PI is 0.90.

B) accept the project because the PI is 1.07.

C) accept the project because the PI is 1.11.

D) reject the project because the PI is 0.90.

E) reject the project because the PI is 1.07.

Correct Answer:

Verified

Correct Answer:

Verified

Q2: An investment project costs $21,500 and has

Q16: A project that provides annual cash flows

Q22: Which one of the following is a

Q63: It will cost $6,000 to acquire an

Q65: Why is payback often used as the

Q74: A project has an initial cost of

Q100: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB5617/.jpg" alt=" -A firm evaluates

Q101: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB5617/.jpg" alt=" -You are considering

Q104: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB5617/.jpg" alt=" -Hungry Hoagie's has

Q107: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB5617/.jpg" alt=" -You are considering