Multiple Choice

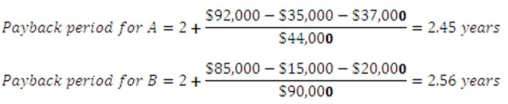

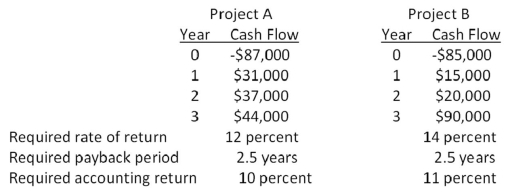

-You are considering the following two mutually exclusive projects.Both projects will be depreciated using straight-line depreciation to a zero book value over the life of the project.Neither project has any salvage value.

Should you accept or reject these projects based on the profitability index?

A) accept Project A and reject Project B

B) reject Project A and accept Project B

C) accept both Projects A and B

D) reject both Projects A and B

E) You cannot make this decision based on the profitability index.

Correct Answer:

Verified

Correct Answer:

Verified

Q2: An investment project costs $21,500 and has

Q16: A project that provides annual cash flows

Q17: Graphing the crossover point helps explain: <br>A) why

Q22: Which one of the following is a

Q63: It will cost $6,000 to acquire an

Q65: Why is payback often used as the

Q74: A project has an initial cost of

Q100: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB5617/.jpg" alt=" -A firm evaluates

Q102: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB5617/.jpg" alt=" -You would like

Q104: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB5617/.jpg" alt=" -Hungry Hoagie's has