Multiple Choice

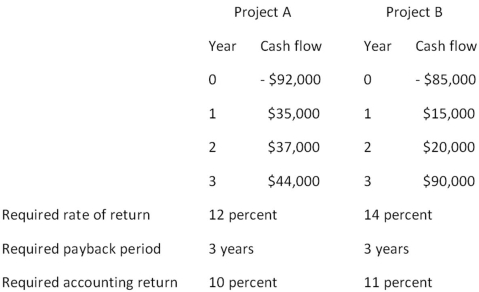

You are considering the following two mutually exclusive projects.Both projects will be depreciated using straight-line depreciation to a zero book value over the life of the project.Neither project has any salvage value.

Should you accept or reject these projects based on payback analysis?

A) accept Project A and reject Project B

B) reject Project A and accept Project B

C) accept both Projects A and B

D) reject both Projects A and B

E) You cannot make this decision based on payback analysis.

Correct Answer:

Verified

Correct Answer:

Verified

Q2: An investment project costs $21,500 and has

Q3: Which one of the following increases the

Q15: Alicia is considering adding toys to her

Q16: A project that provides annual cash flows

Q22: Which one of the following is a

Q23: Applying the discounted payback decision rule to

Q85: Kristi wants to start training her most

Q102: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB5617/.jpg" alt=" -You would like

Q104: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB5617/.jpg" alt=" -Hungry Hoagie's has

Q107: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB5617/.jpg" alt=" -You are considering