Multiple Choice

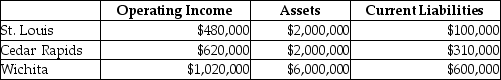

Waldorf Company has two sources of funds: long-term debt with a market and book value of $5,200,000 issued at an interest rate of 13%,and equity capital that has a market value of $4,200,000 (book value of $2,400,000) .Waldorf Company has profit centers in the following locations with the following operating incomes,total assets,and current liabilities.The cost of equity capital is 13%,while the tax rate is 25%.

What is the EVA® for Cedar Rapids? (Round intermediary calculations to four decimal places. )

A) $275,720

B) $465,000

C) $430,720

D) $241,000

Correct Answer:

Verified

Correct Answer:

Verified

Q6: The net present value of all cash

Q7: Team incentives encourage cooperation by _.<br>A) identifying

Q20: Which of the following is true about

Q30: The first step in designing accounting based

Q105: Which of the following is the formula

Q113: Some companies, make environmental performance a line

Q129: Which of the following is a difference

Q145: The top management at Amore Corp,a manufacturer

Q147: Carriage Incorporated manufactures horse carriages.The company has

Q148: Batman Abstract Company has three divisions that