Multiple Choice

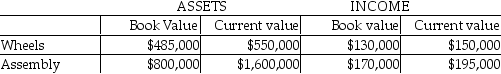

Carriage Incorporated manufactures horse carriages.The company has two divisions,Wheels and Assembly.Because of different accounting methods and inflation rates,the company is considering multiple evaluation measures.The following information is provided for 2018:

The company is currently using a 12% required rate of return.

What are Wheels's and Assembly's return on investment based on book values,respectively?

A) 27%;12%

B) 27%;21%

C) 12%;27%

D) 21%;27%

Correct Answer:

Verified

Correct Answer:

Verified

Q7: Team incentives encourage cooperation by _.<br>A) identifying

Q30: The first step in designing accounting based

Q105: Which of the following is the formula

Q106: A major weakness of comparing two companies

Q113: Some companies, make environmental performance a line

Q129: Which of the following is a difference

Q143: Waldorf Company has two sources of funds:

Q145: The top management at Amore Corp,a manufacturer

Q148: Batman Abstract Company has three divisions that

Q150: Coldbrook Company has two sources of funds: