Multiple Choice

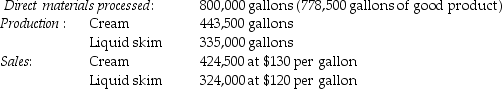

The Alfarm Corporation processes raw milk up to the split-off point where two products,cream and liquid skim,are produced and sold.There was no beginning inventory.The following material was collected for the month of February:

The cost of purchasing 800,000 gallons of direct materials and processing it up to the split-off point to yield a total of 778,500 gallons of good product was $2,350,000.Which of the following statements about Alfarm's joint production costs is true?

A) The gross-margin percentage per gallon of Cream and Liquid skim are equal because joint costs are allocated based on the number of gallons.

B) The gross-margin percentage per gallon of Cream is higher than gross margin percentage per gallon of Liquid skim because of Cream's higher production volume.

C) The joint production cost per gallon of Cream and Liquid skim are equal because joint costs are allocated based on the number of gallons.

D) The joint production cost per gallon of Cream is higher than joint production cost per gallon of Liquid skim because of Cream's higher production volume.

Correct Answer:

Verified

Correct Answer:

Verified

Q1: Red Sauce Canning Company processes tomatoes into

Q7: Berkel Company processes sugar cane into three

Q66: The sales value at split-off method of

Q73: The constant gross-margin percentage NRV method allocates

Q85: Explain the difference between a joint product

Q96: What are the reasons for allocating joint

Q99: The sales method for recognizing byproducts is

Q100: The constant gross-margin percentage NRV method is

Q104: In joint costing, the constant gross-margin percentage

Q148: An example of allocating joint costs using