Essay

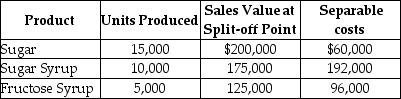

Berkel Company processes sugar cane into three products.During May,the joint costs of processing were $600,000.Production and sales value information for the month were as follows:

Required:

Determine the amount of joint cost allocated to each product if the sales value at split-off method is used.

Correct Answer:

Verified

_TB5540_00...

_TB5540_00...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q3: The Alfarm Corporation processes raw milk up

Q12: Netzone Company is in semiconductor industry and

Q66: The sales value at split-off method of

Q73: The constant gross-margin percentage NRV method allocates

Q85: Explain the difference between a joint product

Q96: What are the reasons for allocating joint

Q99: The sales method for recognizing byproducts is

Q100: The constant gross-margin percentage NRV method is

Q104: In joint costing, the constant gross-margin percentage

Q148: An example of allocating joint costs using