Essay

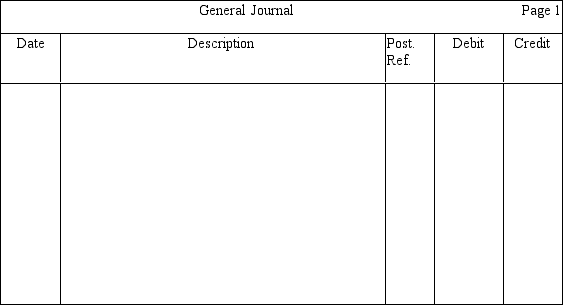

X, Y, and Z are partners who share profits and losses in a ratio of 1:2:3, respectively. Z's Capital account has a $60,000 balance. X and Y have agreed to let Z take $78,000 of the company's cash when he retires. Prepare an entry in journal form without explanation to record Z's exit, including the recognition of a bonus to Z

Correct Answer:

Verified

Correct Answer:

Verified

Q35: If liquidation of a partnership results in

Q37: Each partner is personally liable for all

Q38: Tim and Vito are about to liquidate

Q39: Aaron, Ben, and Carl are liquidating their

Q40: It is possible for a partner's Capital

Q41: Jimmy, Karol, and Lui are partners in

Q46: Bjorn and Canute are partners who

Q49: Only not-for-profit organizations form joint ventures.

Q136: Which of the following will not result

Q144: A limited partnership normally has one or