Essay

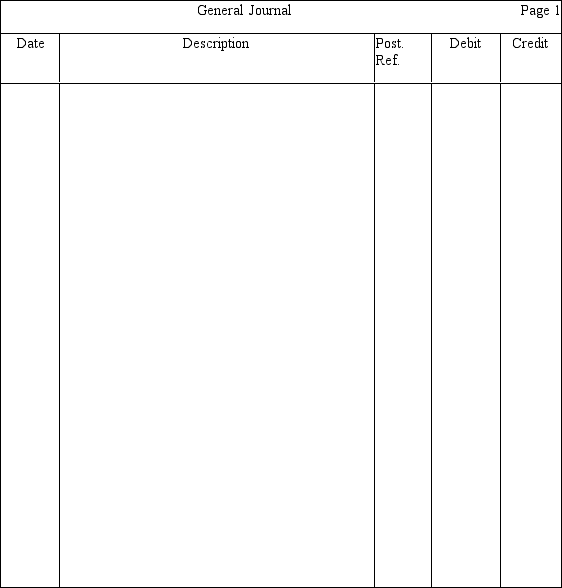

Aaron, Ben, and Carl are liquidating their business. They share income and losses in a 1:2:3 ratio, respectively, and currently have capital balances of $15,000, $13,000, and $12,000, respectively. In addition, the partnership has $5,000 in cash, $15,000 in accounts payable, and $50,000 in noncash assets. Aaron and Ben are personally solvent, but Carl is not. Assuming that the noncash assets are sold for $20,000, prepare all liquidation entries in the journal provided without explanation.

Correct Answer:

Verified

Correct Answer:

Verified

Q34: A partner's inability to meet his or

Q36: Avery and Bert are partners who share

Q37: Each partner is personally liable for all

Q38: Tim and Vito are about to liquidate

Q40: A partnership agreement most likely will stipulate

Q40: It is possible for a partner's Capital

Q41: Jimmy, Karol, and Lui are partners in

Q42: X, Y, and Z are partners who

Q136: Which of the following will not result

Q144: A limited partnership normally has one or