Essay

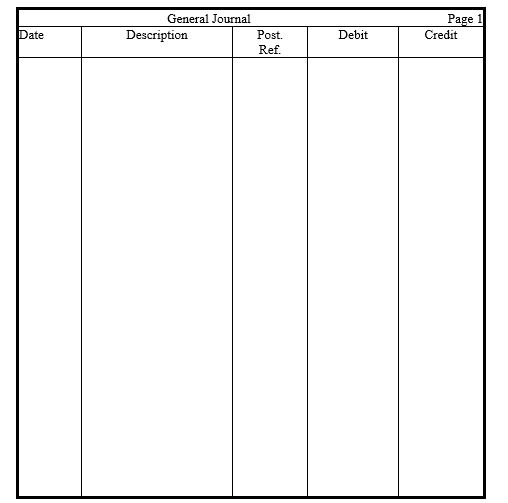

In the journal provided, prepare year-end adjustments for the following situations. Omit explanations.

a. Accrued interest on notes receivable is $105.

b. Of the $12,000 received in advance of earning a service, one-third was still unearned by year end.

c. Three years' rent, totaling $36,000, was paid in advance at the beginning of the year.

d. Services totaling $5,300 had been performed, but not yet billed.

e. Depreciation on trucks totaled $3,400 for the year.

f. Supplies available for use totaled $690. However, by year end, only $100 in supplies remained.

g. Payroll for the five-day work week, to be paid on Friday, is $30,000. Year end falls on a Monday.

Correct Answer:

Verified

Correct Answer:

Verified

Q27: When a direct cause-and-effect relationship cannot be

Q55: An adjusting entry can include a debit

Q57: As an asset's depreciation is recorded, its

Q58: Prepare year-end adjusting entries for each of

Q62: A cash payment that reduces a liability

Q85: Which of the following is the most

Q95: The going concern assumption is not applied

Q136: Which of the following situations is an

Q148: Wages Payable was $350 at the end

Q154: Which of the following transactions results in