Essay

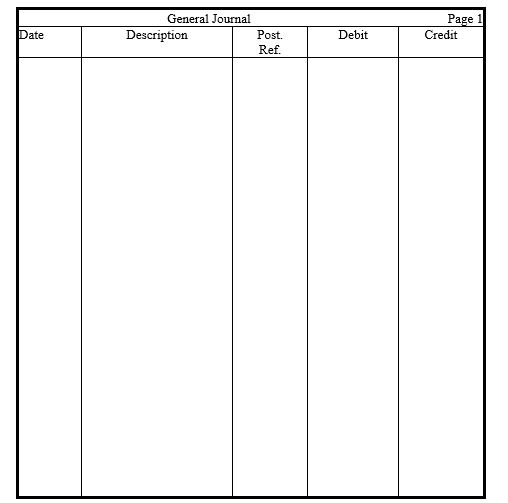

Prepare year-end adjusting entries for each of the following situations:

a. The Store Supplies account showed a beginning debit balance of $400 and purchases of $2,800. The ending debit balance was $800.

b. Depreciation on buildings is estimated to be $7,300.

c. A one-year insurance policy was purchased for $2,400. Nine months have passed since the purchase.

d. Accrued interest on notes payable amounted to $200.

e. The company received a $9,600 advance payment during the year on services to be performed. By the end of the year, one-third of the services had been performed.

f. Payroll for the five-day workweek, to be paid on Friday, is $10,000. The last day of the period is a Tuesday.

g. Services totaling $920 had been performed but not yet billed or recorded.

Correct Answer:

Verified

Correct Answer:

Verified

Q27: When a direct cause-and-effect relationship cannot be

Q53: A company's five-day weekly payroll of $890

Q54: The Store Supplies account had a $360

Q55: An adjusting entry can include a debit

Q57: As an asset's depreciation is recorded, its

Q60: In the journal provided, prepare year-end adjustments

Q62: A cash payment that reduces a liability

Q85: Which of the following is the most

Q95: The going concern assumption is not applied

Q148: Wages Payable was $350 at the end