Essay

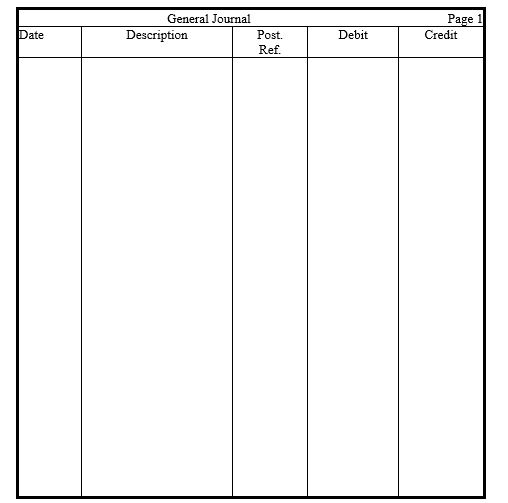

In the journal provided, prepare year-end adjustments for the following situations. Omit explanations.

a. Accrued interest on notes receivable is $560.

b. Of the $7,200 received in advance of earning a service, one-third was still unearned by year end.

c. Two years of rent, totaling $24,000, was paid in advance. By year end, four months' worth had expired.

d. Services totaling $685 had been performed, but not yet billed.

e. Depreciation on trucks totaled $1,700 for the year.

f. Supplies available for use during the year amounted to $3,400. However, by year end, only $700 in supplies remained.

g. Payroll for the five-day work week, to be paid on Friday, is $6,000. Year end falls on a Tuesday.

Correct Answer:

Verified

Correct Answer:

Verified

Q7: An adjusting entry includes at least one

Q44: Unearned Revenue was $600 at the end

Q61: The periodicity assumption recognizes that<br>A)the company may

Q71: Use this information to answer the following

Q72: Which of the following assets is not

Q74: Rice Enterprises had supplies on hand costing

Q78: Unearned Revenue was $2,400 at the end

Q80: On December 12, Roger Kent, a painter,

Q81: An examination of the Prepaid Insurance account

Q168: Assets are converted to revenues as they