Essay

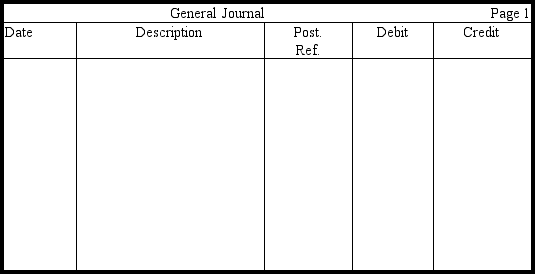

On December 12, Roger Kent, a painter, received $1,800 in advance for performing a service that would extend into the following calendar year. By December 31, he still had three-fourths of the service remaining to perform. In the journal provided, prepare the December 12 entry, the December 31 end-of-period adjustment, as well as the entry on January 29 when the job was completed. Omit explanations.

Correct Answer:

Verified

Correct Answer:

Verified

Q7: An adjusting entry includes at least one

Q44: Unearned Revenue was $600 at the end

Q61: The periodicity assumption recognizes that<br>A)the company may

Q76: In the journal provided, prepare year-end adjustments

Q78: Unearned Revenue was $2,400 at the end

Q81: An examination of the Prepaid Insurance account

Q83: Use the following unadjusted trial balance to

Q114: Distinguish between a deferral and an accrual.

Q142: The accrual basis of accounting results in

Q165: Depreciation Expense-Equipment is an example of a