Essay

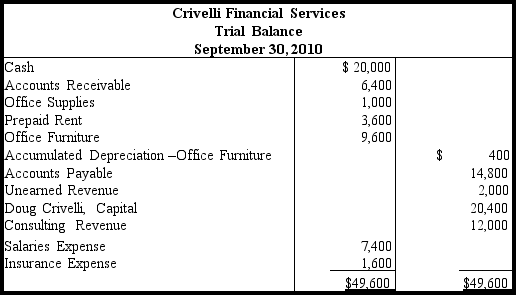

Use the following unadjusted trial balance to prepare adjusting entries, given the additional information below it. Assume financial statements are prepared quarterly. Omit explanations.

a.Of the revenue received in advance, 60 percent remained unearned on September 30.

b.The office furniture has an estimated five-year useful life and zero value at the end of that time. Record depreciation for the quarter.

c.Salaries earned, but unpaid, totaled $1,520.

d.The Prepaid Rent applies to the six months beginning July 1, 2010.

e.Office supplies on hand totaled $300 at the end of the quarter.

f.Services performed but not yet billed or recorded amount to $1,800.

Correct Answer:

Verified

Correct Answer:

Verified

Q18: An adjusted trial balance is prepared to<br>A)test

Q61: The periodicity assumption recognizes that<br>A)the company may

Q62: Adjusting entries are useful in apportioning costs

Q78: Unearned Revenue was $2,400 at the end

Q80: On December 12, Roger Kent, a painter,

Q81: An examination of the Prepaid Insurance account

Q88: A net loss results in a decrease

Q114: Distinguish between a deferral and an accrual.

Q142: The accrual basis of accounting results in

Q165: Depreciation Expense-Equipment is an example of a