Multiple Choice

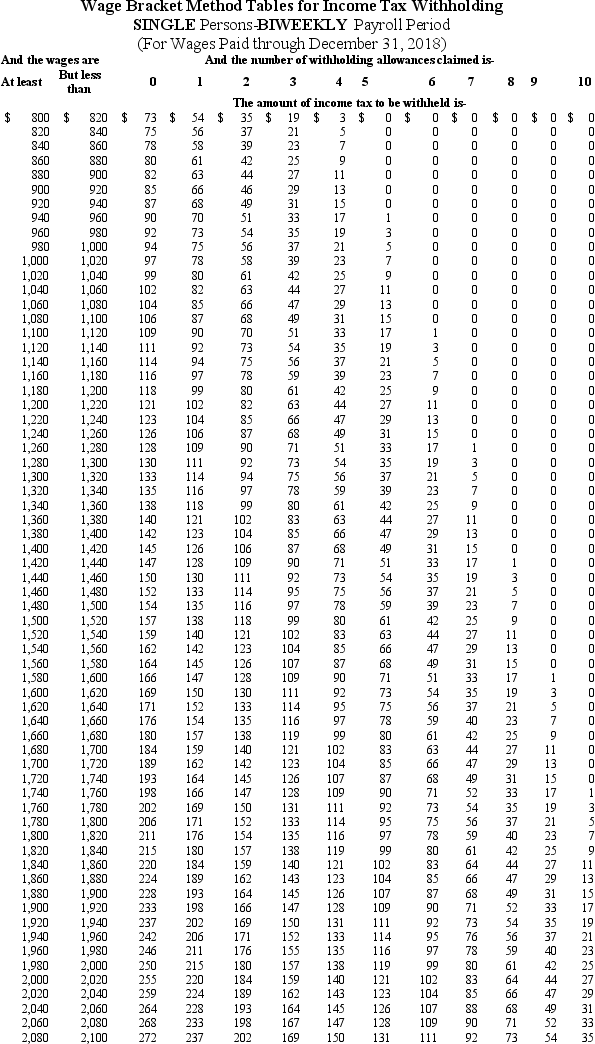

Caroljane earned $1,120 during the most recent pay biweekly pay period.She contributes 4% of her gross pay to her 401(k) plan.She is single and has 1 withholding allowance.Based on the following table,how much Federal income tax should be withheld from her pay?

A) $106.00

B) $104.00

C) $87.00

D) $85.00

Correct Answer:

Verified

Correct Answer:

Verified

Q15: Garnishments are court-ordered amounts that an employer

Q20: Computation of net pay involves deducting mandatory

Q52: Amanda is a full-time exempt employee in

Q53: Which of the following is the correct

Q54: Ramani earned $1,698.50 during the most recent

Q55: Which are steps in the net pay

Q59: Which of the following states do not

Q60: The factors that determine an employee's federal

Q61: Why do employers use checks as an

Q62: From the employer's perspective,which of the following