Multiple Choice

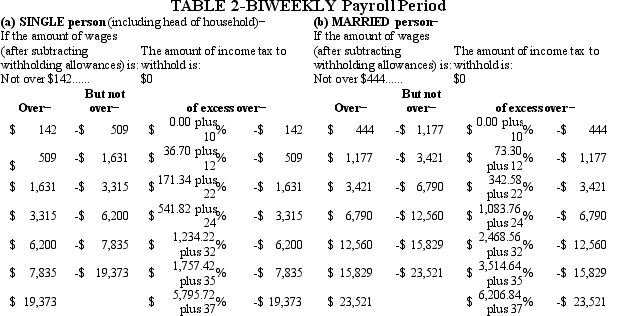

Amanda is a full-time exempt employee in Sparks,Nevada,who earns $84,000 annually.She is married with 1 deduction and is paid biweekly.She contributes $150.00 per pay period to her 401(k) and has pre-tax health insurance and AFLAC deductions of $50.00 and $75.00,respectively.Amanda contributes $25.00 per pay period to the United Way.What is her net pay? (Use the percentage method.Do not round intermediate calculations.Round final answers to 2 decimal places. )

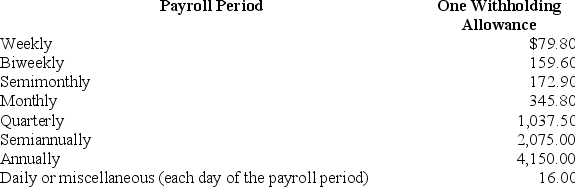

Table 5.Percentage Method-2018 Amount for one Withholding Allowance

A) $2,394.47

B) $2,193.60

C) $2,425.58

D) $2,605.44

Correct Answer:

Verified

Correct Answer:

Verified

Q20: Computation of net pay involves deducting mandatory

Q47: The purpose of the wage base used

Q48: Which of the following is used in

Q49: Max earned $1,019.55 during the most recent

Q50: Paolo is a part-time security guard for

Q51: Warren is a married employee with six

Q53: Which of the following is the correct

Q54: Ramani earned $1,698.50 during the most recent

Q55: Which are steps in the net pay

Q57: Caroljane earned $1,120 during the most recent