Multiple Choice

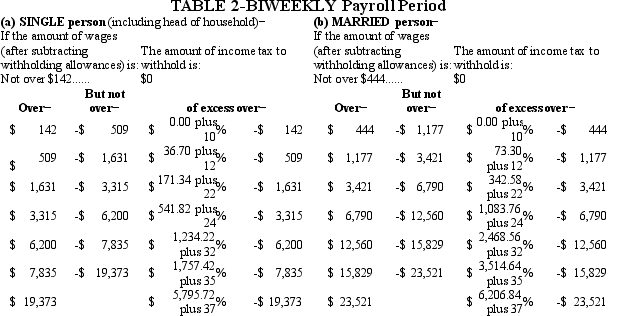

Warren is a married employee with six withholding allowances.During the most recent biweekly pay period,he earned $9,450.00.Using the percentage method,compute Warren's federal income tax.(Do not round intermediate calculations.Round your final answer to 2 decimal places. )

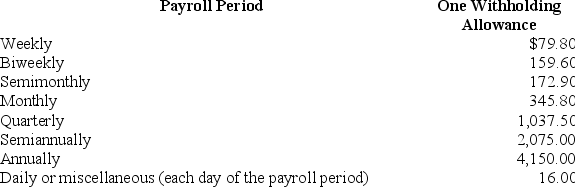

Table 5.Percentage Method-2018 Amount for one Withholding Allowance

A) $1,490.15

B) $1,456.90

C) $1,512.91

D) $1,492.34

Correct Answer:

Verified

Correct Answer:

Verified

Q20: Computation of net pay involves deducting mandatory

Q46: State and Local Income Tax rates _.<br>A)exist

Q47: The purpose of the wage base used

Q48: Which of the following is used in

Q49: Max earned $1,019.55 during the most recent

Q50: Paolo is a part-time security guard for

Q52: Amanda is a full-time exempt employee in

Q53: Which of the following is the correct

Q54: Ramani earned $1,698.50 during the most recent

Q55: Which are steps in the net pay