Multiple Choice

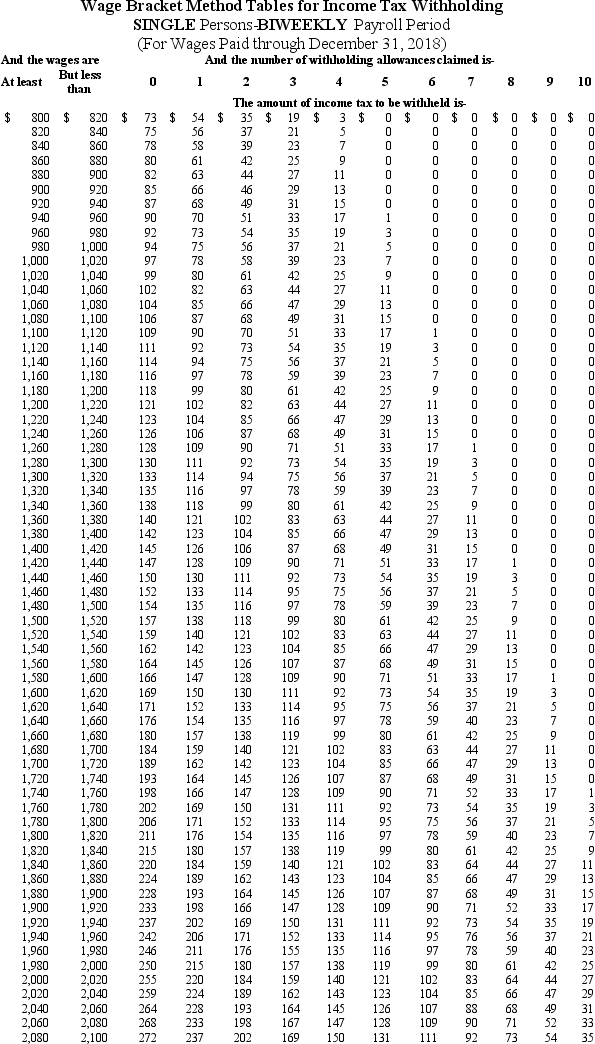

Julian is a part-time nonexempt employee in Nashville,Tennessee,who earns $21.50 per hour.During the last biweekly pay period he worked 45 hours,5 of which are considered overtime.He is single with one withholding allowance (use the wage-bracket table) .What is his net pay? (Do not round intermediate calculations.Round your final answer to 2 decimal places. )

A) $818.40

B) $797.18

C) $825.99

D) $863.12

Correct Answer:

Verified

Correct Answer:

Verified

Q6: The use of paycards as a means

Q6: Jesse is a part-time nonexempt employee in

Q8: Post-Tax Deductions are amounts _.<br>A)That are voluntarily

Q9: Trish earned $1,734.90 during the most recent

Q10: Melody is a full-time employee in Sioux

Q12: Garnishments may include deductions from employee wages

Q13: Which of the following statements is/are true

Q14: The percentage method of determining an employee's

Q15: Steve is a full-time exempt employee at

Q16: Which of the following statements is/are true