Multiple Choice

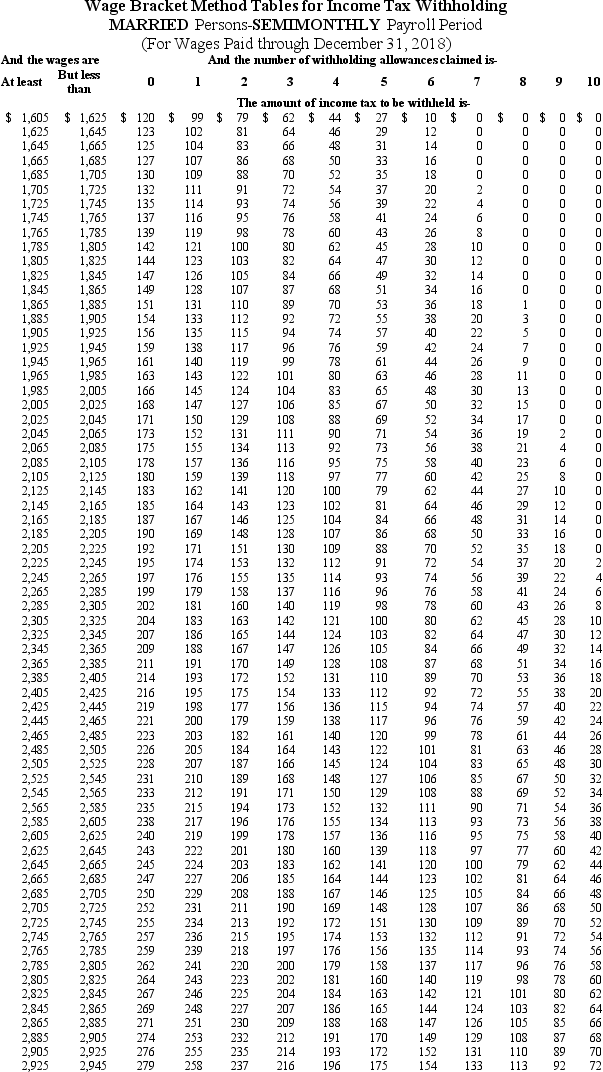

Trish earned $1,734.90 during the most recent semimonthly pay period.She is married and has 3 withholding allowances and has no pre-tax deductions.Based on the following table,how much should be withheld from her gross pay for Federal income tax?

A) $74.00

B) $93.00

C) $76.00

D) $95.00

Correct Answer:

Verified

Correct Answer:

Verified

Q4: The percentage of the Medicare tax withholding

Q5: Danny is a full-time exempt employee in

Q6: The use of paycards as a means

Q6: Jesse is a part-time nonexempt employee in

Q8: Post-Tax Deductions are amounts _.<br>A)That are voluntarily

Q10: Melody is a full-time employee in Sioux

Q11: Julian is a part-time nonexempt employee in

Q12: Garnishments may include deductions from employee wages

Q13: Which of the following statements is/are true

Q14: The percentage method of determining an employee's