Multiple Choice

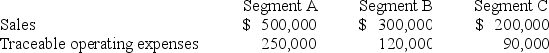

Tuttle Company discloses supplementary operating segment information for its three reportable segments.Data for 20X3 are available as follows:

Additional 20X3 expenses include indirect operating expenses of $100,000.Appropriately selected common indirect operating expenses are allocated to segments based on the ratio of each segment's sales to total sales.The 20X3 operating profit for Segment A was:

A) $150,000

B) $180,000

C) $200,000

D) $250,000

Correct Answer:

Verified

Correct Answer:

Verified

Q54: Assume that the replacement did not happen

Q55: Operand Corporation reported consolidated revenues of $30,000,000

Q56: During the third quarter of 20X4,Ripley Company

Q57: Forge Company,a calendar-year entity,had 6,000 units in

Q58: Denver Company,a calendar-year corporation,had the following actual

Q59: Wakefield Company uses a perpetual inventory system.In

Q60: ASC 280 requires certain disclosures about major

Q61: Wakefield Company uses a perpetual inventory system.In

Q62: An analysis of Abbey Company's operating segments

Q63: Stone Company reported $100,000,000 of revenues on