Multiple Choice

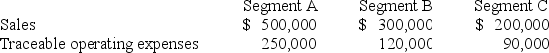

Tuttle Company discloses supplementary operating segment information for its three reportable segments.Data for 20X3 are available as follows:

Allocable costs for the year were $54,000.Allocable costs are assigned based on the ratio of a segment's income before allocable costs to total income before allocable costs.The 20X3 operating profit for Segment A was:

A) $196,000

B) $223,000

C) $225,000

D) $250,000

Correct Answer:

Verified

Correct Answer:

Verified

Q41: FASB has specified a "75% percent consolidated

Q42: All of the following situations require a

Q43: Follett Company incurred a first quarter operating

Q44: On June 30,20X8,String Corporation incurred a $220,000

Q45: Which of the following are established by

Q47: The income tax expense applicable to the

Q48: Daniel Corporation,which has a fiscal year ending

Q49: Samuel Corporation foresees a downturn in its

Q50: Chicago Company,a calendar-year corporation,had the following actual

Q51: Main Manufacturing Corporation reported consolidated revenues of