Multiple Choice

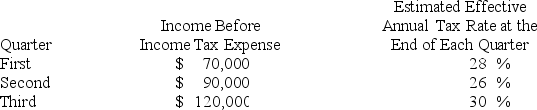

Chicago Company,a calendar-year corporation,had the following actual income before income tax expense and estimated effective annual income tax rates for the first three quarters in 20X2:

Chicago's income tax expense in its interim income statement for the third quarter should be:

A) $36,000

B) $41,000

C) $42,400

D) $84,000

Correct Answer:

Verified

Correct Answer:

Verified

Q45: Which of the following are established by

Q46: Tuttle Company discloses supplementary operating segment information

Q47: The income tax expense applicable to the

Q48: Daniel Corporation,which has a fiscal year ending

Q49: Samuel Corporation foresees a downturn in its

Q51: Main Manufacturing Corporation reported consolidated revenues of

Q52: Derby Company pays its executives a bonus

Q53: Estimated gross profit rates may be used

Q54: Assume that the replacement did not happen

Q55: Operand Corporation reported consolidated revenues of $30,000,000