Multiple Choice

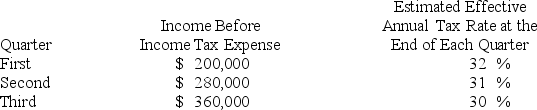

Toledo Imports,a calendar-year corporation,had the following income before tax expense and estimated effective annual income tax rates for the first three quarters in 20X8:

Toledo's income tax expense in its interim income statement for the nine months ended September 30 and for the third quarter,respectively,are:

A) $250,800 and $103,200.

B) $252,000 and $108,000.

C) $252,000 and $103,200.

D) $250,800 and $108,000.

Correct Answer:

Verified

Correct Answer:

Verified

Q17: On March 15,20X7,Barrel Company paid property taxes

Q18: Forge Company,a calendar-year entity,had 6,000 units in

Q19: Trimester Corporation's revenue for the year ended

Q20: ASC 280,Disclosure about Segments of an Enterprise

Q21: Lloyd Corporation reports the following information for

Q23: Trevor Company discloses supplementary operating segment information

Q24: Forge Company,a calendar-year entity,had 6,000 units in

Q25: During the third quarter of 20X8,Pride Company

Q26: Biometric Corporation's revenue for the year ended

Q27: Wakefield Company uses a perpetual inventory system.In