Essay

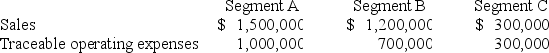

Lloyd Corporation reports the following information for 20X8 for its three operating segments:

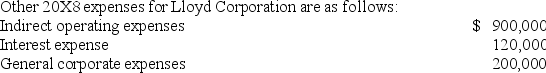

Indirect operating expenses are allocated to segments based upon the ratio of each segment's traceable operating expenses to total traceable operating expenses.Interest expense is allocated to segments based upon the ratio of each segment's sales to total sales.

Required:

a)Calculate the operating profit or loss for each of the segments for 20X8.

b)Determine which segments are reportable,applying the operating profit or loss test.

Correct Answer:

Verified

a)Operating profit or loss for each segm...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q16: William Corporation,which has a fiscal year ending

Q17: On March 15,20X7,Barrel Company paid property taxes

Q18: Forge Company,a calendar-year entity,had 6,000 units in

Q19: Trimester Corporation's revenue for the year ended

Q20: ASC 280,Disclosure about Segments of an Enterprise

Q22: Toledo Imports,a calendar-year corporation,had the following income

Q23: Trevor Company discloses supplementary operating segment information

Q24: Forge Company,a calendar-year entity,had 6,000 units in

Q25: During the third quarter of 20X8,Pride Company

Q26: Biometric Corporation's revenue for the year ended