Multiple Choice

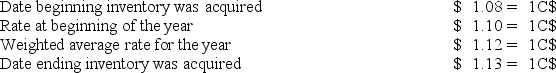

The Canadian subsidiary of a U.S.company reported cost of goods sold of 50,000 C$,for the current year ended December 31.The beginning inventory was 15,000 C$,and the ending inventory was 10,000 C$.Spot rates for various dates are as follows:

Assuming the Canadian dollar is the functional currency of the Canadian subsidiary,the translated amount of cost of goods sold that should appear in the consolidated income statement is

A) $50,000.

B) $55,300.

C) $56,000.

D) $56,500.

Correct Answer:

Verified

Correct Answer:

Verified

Q17: Which of the following statements is true

Q18: In cases of operations located in highly

Q19: On January 2,20X8,Polaris Company acquired a 100%

Q20: Under the temporal method,which of the following

Q21: On January 2,20X8,Polaris Company acquired a 100%

Q23: Barcode Corporation acquired 70% of the common

Q24: If the functional currency is the local

Q25: On January 1,20X8,Pullman Corporation acquired 75 percent

Q26: Briefly explain the following terms associated with

Q27: When the local currency of a foreign