Multiple Choice

On January 2,20X8,Polaris Company acquired a 100% interest in the capital stock of Ski Company for $3,100,000.Any excess cost over book value is attributable to a patent with a 10-year remaining life.At the date of acquisition,Ski's balance sheet contained the following information:

Ski's income statement for 20X8 is as follows:

Ski's income statement for 20X8 is as follows:

The balance sheet of Ski at December 31,20X8,is as follows:

The balance sheet of Ski at December 31,20X8,is as follows:

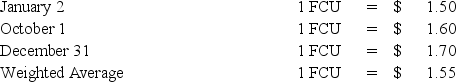

Ski declared and paid a dividend of 20,000 FCU on October 1,20X8.Spot rates at various dates for 20X8 follow:

Ski declared and paid a dividend of 20,000 FCU on October 1,20X8.Spot rates at various dates for 20X8 follow:

Assume Ski's revenues,purchases,operating expenses,depreciation expense,and income taxes were incurred evenly throughout 20X8.

Assume Ski's revenues,purchases,operating expenses,depreciation expense,and income taxes were incurred evenly throughout 20X8.

-Refer to the above information.Assuming the U.S.dollar is the functional currency,what is Polaris's remeasurement gain (loss) for 20X8? (Assume the ending inventory was acquired on December 31,20X8. )

A) $31,000 gain

B) $36,500 loss

C) $22,000 gain

D) $32,000 gain

Correct Answer:

Verified

Correct Answer:

Verified

Q16: Parent Company's wholly-owned subsidiary,Son Corporation,maintains its accounting

Q17: Which of the following statements is true

Q18: In cases of operations located in highly

Q19: On January 2,20X8,Polaris Company acquired a 100%

Q20: Under the temporal method,which of the following

Q22: The Canadian subsidiary of a U.S.company reported

Q23: Barcode Corporation acquired 70% of the common

Q24: If the functional currency is the local

Q25: On January 1,20X8,Pullman Corporation acquired 75 percent

Q26: Briefly explain the following terms associated with