Elan,a USCorporation,completed the December 31,20X8,foreign Currency Translation of Its 70 Percent

Multiple Choice

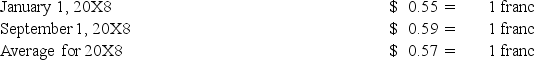

Elan,a U.S.corporation,completed the December 31,20X8,foreign currency translation of its 70 percent owned Swiss subsidiary's trial balance using the current rate method.The translation resulted in a debit adjustment of $25,000.The subsidiary had reported net income of 800,000 Swiss francs for 20X8 and paid dividends of 50,000 Swiss francs on September 1,20X8.The translation rates for the year were:

The January 1 balance of the Investment in the Swiss subsidiary account was $1,600,000.Elan acquired its interest in the Swiss subsidiary at book value with no differential or goodwill recorded at acquisition.

Elan's Investment in Swiss subsidiary account at December 31,20X8,is:

A) $1,881,050.

B) $1,916,050.

C) $1,923,950.

D) $2,051,500.

Correct Answer:

Verified

Correct Answer:

Verified

Q1: Infinity Corporation acquired 80 percent of the

Q2: If the restatement method for a foreign

Q3: On January 2,20X8,Polaris Company acquired a 100%

Q4: Infinity Corporation acquired 80 percent of the

Q6: Michigan-based Leo Corporation acquired 100 percent of

Q7: On January 2,20X8,Polaris Company acquired a 100%

Q8: Nichols Company owns 90% of the capital

Q9: On January 2,20X8,Polaris Company acquired a 100%

Q10: On January 2,20X8,Polaris Company acquired a 100%

Q11: All of the following are benefits the