Multiple Choice

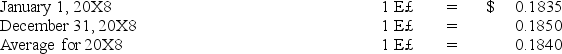

Infinity Corporation acquired 80 percent of the common stock of an Egyptian company on January 1,20X8.The goodwill associated with this acquisition was $18,350.Exchange rates at various dates during 20X8 follow:

Goodwill suffered an impairment of 20 percent during the year.If the functional currency is the U.S.dollar,how much goodwill impairment loss should be reported on Infinity's consolidated statement of income for 20X8?

A) $3,680

B) $3,670

C) $3,690

D) $3,700

Correct Answer:

Verified

Correct Answer:

Verified

Q2: If the restatement method for a foreign

Q3: On January 2,20X8,Polaris Company acquired a 100%

Q4: Infinity Corporation acquired 80 percent of the

Q5: Elan,a U.S.corporation,completed the December 31,20X8,foreign currency translation

Q6: Michigan-based Leo Corporation acquired 100 percent of

Q7: On January 2,20X8,Polaris Company acquired a 100%

Q8: Nichols Company owns 90% of the capital

Q9: On January 2,20X8,Polaris Company acquired a 100%

Q10: On January 2,20X8,Polaris Company acquired a 100%

Q11: All of the following are benefits the