Multiple Choice

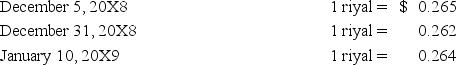

On December 5,20X8,Texas based Imperial Corporation purchased goods from a Saudi Arabian firm for 100,000 riyals (SAR) ,to be paid on January 10,20X9.The transaction is denominated in Saudi riyals.Imperial's fiscal year ends on December 31,and its reporting currency is the U.S.dollar.The exchange rates are:

-Based on the preceding information,what was the overall foreign currency gain or loss on the accounts payable transaction?

A) $300 loss

B) $200 loss

C) $100 gain

D) $200 gain

Correct Answer:

Verified

Correct Answer:

Verified

Q30: Company X issues variable-rate debt but wishes

Q31: On November 1,20X8,Denver Company borrowed 500,000 local

Q32: On November 6,20X7,Zucor Corp.purchased merchandise from an

Q33: On September 3,20X8,Jackson Corporation purchases goods for

Q34: On December 1,20X8,Hedge Company entered into a

Q36: On December 1,20X8,Denizen Corporation entered into a

Q37: Taste Bits Inc.purchased chocolates from Switzerland for

Q38: Spiraling crude oil prices prompted AMAR Company

Q39: Taste Bits Inc.purchased chocolates from Switzerland for

Q40: Suppose the direct foreign exchange rates in