Multiple Choice

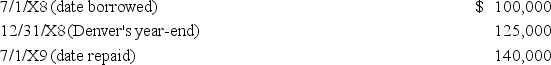

On November 1,20X8,Denver Company borrowed 500,000 local currency units (LCU) from a foreign lender evidenced by an interest-bearing note due on November 1,20X9,which is denominated in the currency of the lender.The U.S.dollar equivalent of the note principal was as follows:

In its income statement for 20X9,what amount should Denver include as a foreign exchange gain or loss on the note principal?

A) $15,000 gain

B) $25,000 gain

C) $15,000 loss

D) $40,000 loss

Correct Answer:

Verified

Correct Answer:

Verified

Q26: Tinitoys,Inc. ,a domestic company,purchased inventory from a

Q27: Myway Company sold equipment to a Canadian

Q28: Heavy Company sold metal scrap to a

Q29: Highland Company sold goods to an Egyptian

Q30: Company X issues variable-rate debt but wishes

Q32: On November 6,20X7,Zucor Corp.purchased merchandise from an

Q33: On September 3,20X8,Jackson Corporation purchases goods for

Q34: On December 1,20X8,Hedge Company entered into a

Q35: On December 5,20X8,Texas based Imperial Corporation purchased

Q36: On December 1,20X8,Denizen Corporation entered into a