Multiple Choice

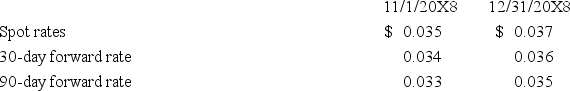

Levin company entered into a forward contract to speculate in the foreign currency.It sold 100,000 foreign currency units under a contract dated November 1,20X8,for delivery on January 31,20X9:

In its income statement for the year ended December 31,20X8,what amount of loss should Levin report from this forward contract?

A) $0

B) $300

C) $200

D) $100

Correct Answer:

Verified

Correct Answer:

Verified

Q48: On December 1,20X8,Hedge Company entered into a

Q49: Heavy Company sold metal scrap to a

Q50: Tinitoys,Inc. ,a domestic company,purchased inventory from a

Q51: On December 1,20X8,Hedge Company entered into a

Q52: Suppose the direct foreign exchange rates in

Q54: An investor purchases a put option with

Q55: Robert Company sold inventory to an Australian

Q56: On December 1,20X8,Winston Corporation acquired 10 deep

Q57: On December 1,20X8,Winston Corporation acquired 10 deep

Q58: The fair market value of a near-month