Multiple Choice

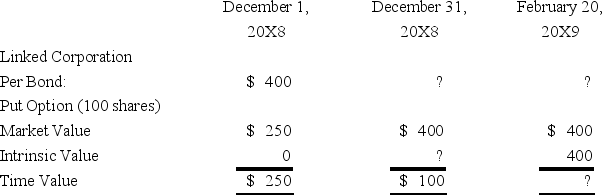

On December 1,20X8,Winston Corporation acquired 10 deep discount bonds from Linked Corporation at a cost of $400 per bond.Winston classifies them as available-for-sale securities.On this same date,it decides to hedge against a possible decline in the value of the securities by purchasing,at a cost of $250,an at-the-money put option to sell the 10 bonds at $400 per bond.The option expires on February 20,20X9.Selected information concerning the fair values of the investment and the options follow:

Assume that Winston exercises the put option and sells Linked bonds on February 20,20X9.

Assume that Winston exercises the put option and sells Linked bonds on February 20,20X9.

-Based on the preceding information,what is the market price of Linked Corporation bonds on December 31,20X8?

A) $400

B) $370

C) $360

D) $380

Correct Answer:

Verified

Correct Answer:

Verified

Q56: On December 1,20X8,Winston Corporation acquired 10 deep

Q57: On December 1,20X8,Winston Corporation acquired 10 deep

Q58: The fair market value of a near-month

Q59: On December 5,20X8,Texas based Imperial Corporation purchased

Q60: On December 1,20X8,Hedge Company entered into a

Q62: Mint Corporation has several transactions with foreign

Q63: Spartan Company purchased interior decoration material from

Q64: All of the following are management tools

Q65: Which of the following observations is true

Q66: Robert Company sold inventory to an Australian