Multiple Choice

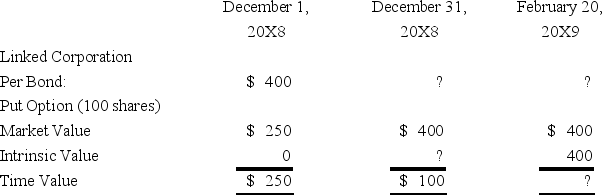

On December 1,20X8,Winston Corporation acquired 10 deep discount bonds from Linked Corporation at a cost of $400 per bond.Winston classifies them as available-for-sale securities.On this same date,it decides to hedge against a possible decline in the value of the securities by purchasing,at a cost of $250,an at-the-money put option to sell the 10 bonds at $400 per bond.The option expires on February 20,20X9.Selected information concerning the fair values of the investment and the options follow:

Assume that Winston exercises the put option and sells Linked bonds on February 20,20X9.

Assume that Winston exercises the put option and sells Linked bonds on February 20,20X9.

-Based on the preceding information,what is the market price of Linked Corporation bonds on February 20,20X9?

A) $350

B) $370

C) $360

D) $400

Correct Answer:

Verified

Correct Answer:

Verified

Q52: Suppose the direct foreign exchange rates in

Q53: Levin company entered into a forward contract

Q54: An investor purchases a put option with

Q55: Robert Company sold inventory to an Australian

Q56: On December 1,20X8,Winston Corporation acquired 10 deep

Q58: The fair market value of a near-month

Q59: On December 5,20X8,Texas based Imperial Corporation purchased

Q60: On December 1,20X8,Hedge Company entered into a

Q61: On December 1,20X8,Winston Corporation acquired 10 deep

Q62: Mint Corporation has several transactions with foreign