Multiple Choice

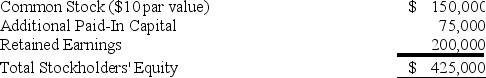

Peacoat Corporation acquired 80 percent of Sweater Corporation's common stock on March 31,20X4 for $360,000.At that date,the fair value of the noncontrolling interest was $90,000.On January 1,20X4,Sweater reported the following stockholders' equity balances:

Sweater reported net income of $100,000 in 20X4,earned uniformly throughout the year,and declared and paid dividends of $40,000 on December 31,20X4.Peacoat reported retained earnings of $500,000 on January 1,20X8,and had 20X4 income of $200,000 from its separate operations.Peacoat paid dividends of $50,000 on December 31,20X4.Peacoat accounts for its investment in Sweater Corporation using the fully adjusted equity method.

Sweater reported net income of $100,000 in 20X4,earned uniformly throughout the year,and declared and paid dividends of $40,000 on December 31,20X4.Peacoat reported retained earnings of $500,000 on January 1,20X8,and had 20X4 income of $200,000 from its separate operations.Peacoat paid dividends of $50,000 on December 31,20X4.Peacoat accounts for its investment in Sweater Corporation using the fully adjusted equity method.

-Based on the information provided,what is the amount of consolidated retained earnings as of December 31,20X4?

A) $500,000

B) $710,000

C) $725,000

D) $760,000

Correct Answer:

Verified

Correct Answer:

Verified

Q11: On July 1,20X8,Pair Logic Corporation acquires 75

Q12: Company P holds 70 percent of the

Q13: Pure Life Corporation has just finished preparing

Q14: Polar Corporation's consolidated cash flow statement for

Q15: Plexis Corporation holds 70 percent of Solar

Q17: Sigma Company develops and markets organic food

Q18: Which sections of the cash flow statement

Q19: Power Corporation's controller has just finished preparing

Q20: Pain Corporation holds 90 percent of Soothing

Q21: Polar Corporation's consolidated cash flow statement for