Multiple Choice

Company P holds 70 percent of the voting shares of Company S.During 20X8,Company S sold land with a book value of $125,000 to Company P for $150,000.Company P continues to hold the land at the end of the year.The companies file separate tax returns and are subject to a 40 percent tax rate.Assume that Company P uses the fully adjusted equity method in accounting for its investment in Company S.

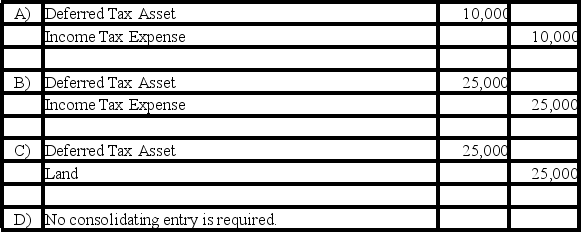

-Based on the information given,which consolidating entry relating to the intercorporate sale of land is to be entered in the consolidation worksheet prepared at the end of 20X8?

A) Option A

B) Option B

C) Option C

D) Option D

Correct Answer:

Verified

Correct Answer:

Verified

Q7: Plexis Corporation holds 70 percent of Solar

Q8: Pure Life Corporation has just finished preparing

Q9: On January 1,20X8,Putter Corporation acquired 40 percent

Q10: Pain Corporation holds 90 percent of Soothing

Q11: On July 1,20X8,Pair Logic Corporation acquires 75

Q13: Pure Life Corporation has just finished preparing

Q14: Polar Corporation's consolidated cash flow statement for

Q15: Plexis Corporation holds 70 percent of Solar

Q16: Peacoat Corporation acquired 80 percent of Sweater

Q17: Sigma Company develops and markets organic food